Beginners are usually advised to start trading with the popular EUR or GBP – it is not surprising that they quickly leave their money to the market. Statistics show that among those who survived the first stage of training, there are more lovers of raw material assets. In fact, the complexity of the fundamental analysis of AUD assets is greatly exaggerated, the risks of trading are much lower, and it is possible to cooperate with the “eastern character”. So – let’s get started.

General information

Australian dollar (AUD, A $, AU $, Aussie, Ozzy) is the monetary unit of the Australian Union countries and several island micro-states in the region. On February 14, 1966, it replaced the duodecimal equivalent of the British pound and had been considered a freely convertible currency since 1983.

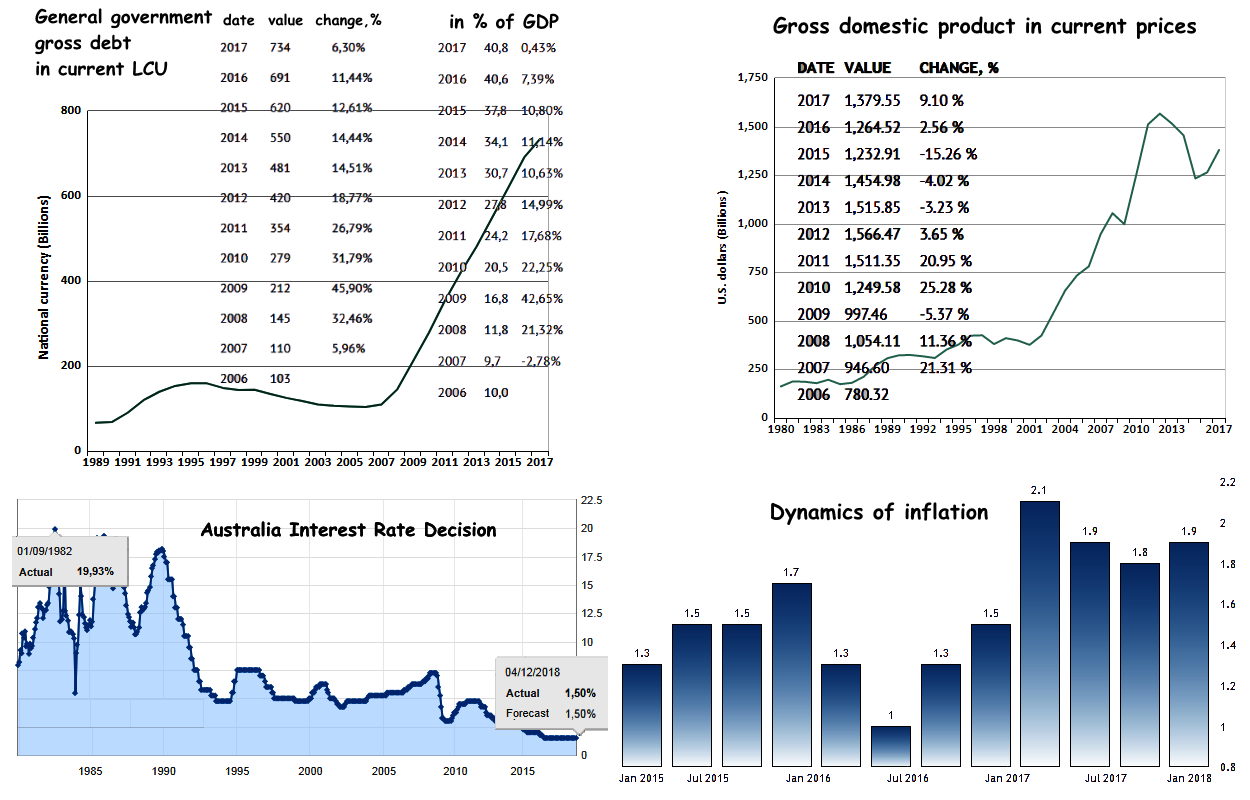

Country GDP over $ 1.27 trillion (as of December 2018) is considered the most significant and most stable economic system – approximately 2.3% of the global economy.

The Australian Securities Exchange (ASX) takes 8th place in market capitalization among global trading floors. The priority of Australia’s economic policy is the course towards international integration: the country is an active participant in Asia-Pacific Economic Cooperation (APEC), G20, OECD and WTO.

The country ranks second in the world in terms of iron ore reserves, has significant volumes of gold, oil (light grades), natural gas, brown and hard coal, bauxite, uranium ore and manganese. Since 2012, it has been considered the world leader in the production and export of nickel. The Australian economy has not experienced a recession for more than 30 years, private and public investment in primary industries, including agriculture, can successfully compensate for the negative of global crises.

The popularity of the Aussie in the speculative market is based on the economy’s stability and the relatively independent monetary policy of the RBA.

Even though in recent years interest rates have been reduced (as of December 2018 – 1.5%), special state programs encourage the influx of “cheap” money into industries unrelated to mining. Besides, AUD is actively used by major Asian players for hedging operations.

Let’s take a closer look.

Features of fundamental analysis

Recall a few general characteristics of Southeast Asian currency assets:

- independence of monetary policy from internal and external factors;

- commodity-oriented economic policies;

- synchronous response to fundamental factors – global and regional;

- dependence on the dynamics of stock markets in Asia and America;

- a strong influence of prices of industrial raw materials and energy resources on the exchange rate.

The basic AUD/USD pair is seriously influenced by national statistics (discount rate, GDP, inflation, unemployment, CPI, PMI), as well as similar data from the USA, Japan, China, statements and comments by officials and representatives of large businesses in these countries.

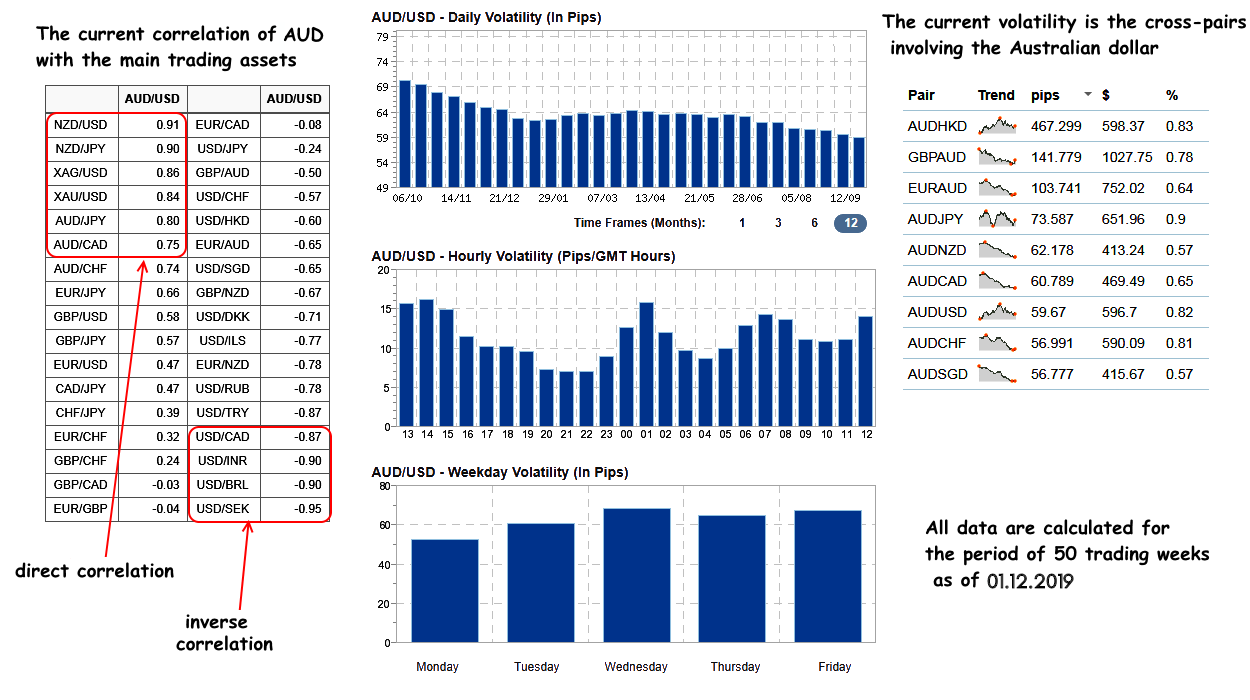

Be sure to monitor the dynamics of prices for industrial raw materials (gold, oil, agricultural products, iron ore, non-ferrous metals), as well as Nikkei 225, TOPIX, KOSPI, SET50, Hang Seng, Composite, S&P500.

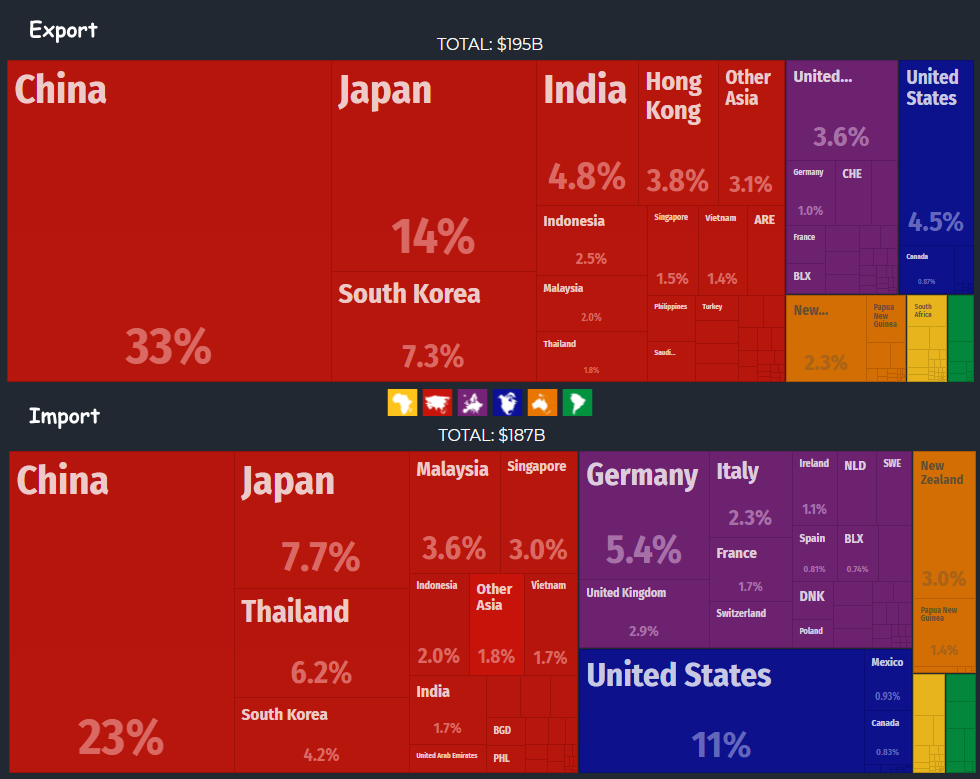

Australia is heavily dependent on foreign trade with trading partners in the region (Japan, China, Malaysia, Indonesia, Singapore). The fundamental analysis of AUD/USD necessarily includes a review of the current dynamics of Asian stock markets and the situation in China. Weak statistics on China always reflects on the dynamics of the Australian currency, but a positive one causes a similar reaction quite rarely.

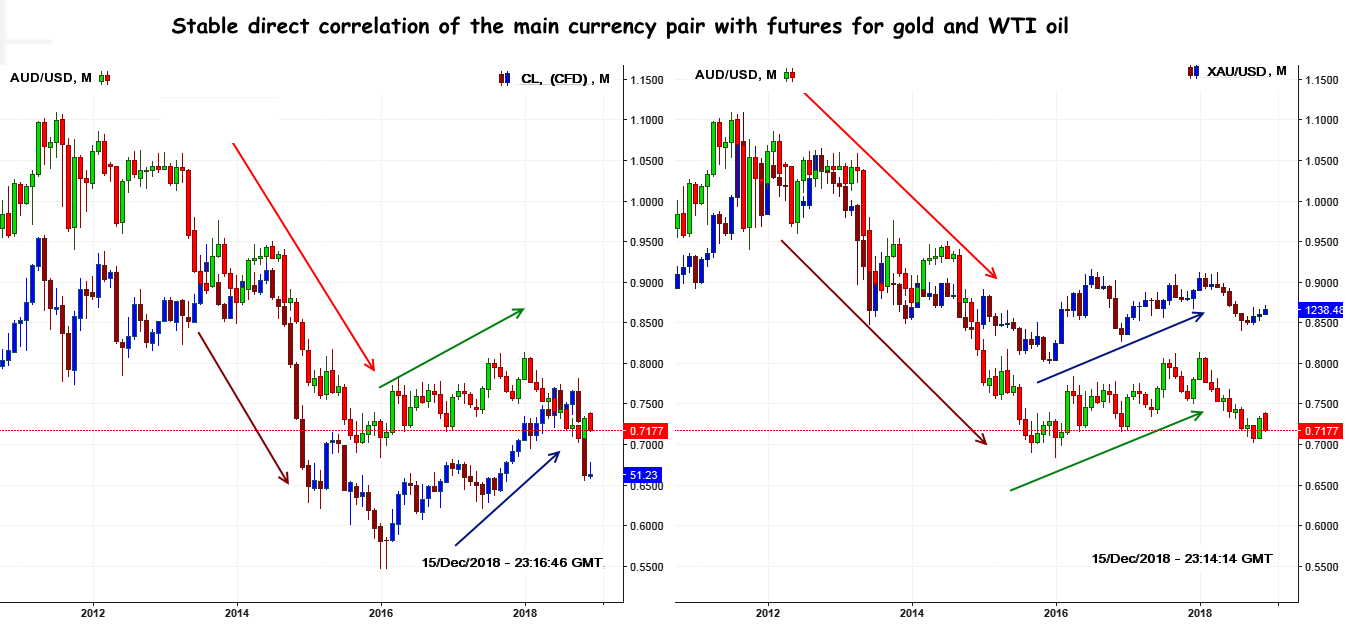

The dynamics of Aussie for many years have shown a strong direct correlation with gold and US oil futures.

Ozzy is the first to react to any speculative actions and currency interventions (including hidden ones) of the Japanese yen and Chinese yuan (after a maximum of 15 minutes). AUD gives a strong reaction to its fundamental events with virtually no kickbacks.

Features of technical analysis

The most liquid Aussie assets are AUD/USD, AUD/JPY, AUD/NZD and EUR/AUD – their volatility is always confirmed by real volumes, and the spreads for these currency pairs are quite reasonable. Peak activity is observed in the Asian trading session (up to 11% of the total); stable volumes are maintained since the opening of trading in London and lasts for the first three hours of the American session. Then large industrial volumes leave the market and activity drops sharply before the opening of exchange in Japan.

The main AUD/USD pair lends itself perfectly to classical technical analysis, steadily fulfils standard graphic patterns, support/resistance levels.

It means that it is most profitable for beginners to trade AUD/USD precisely during the period of the exchange’s work in Sydney – then only the news from Australia itself can “crush” the Aussie rate. The single exception is the pair AUD/JPY since the period of maximum business activity in both countries coincides.

Trading on the news

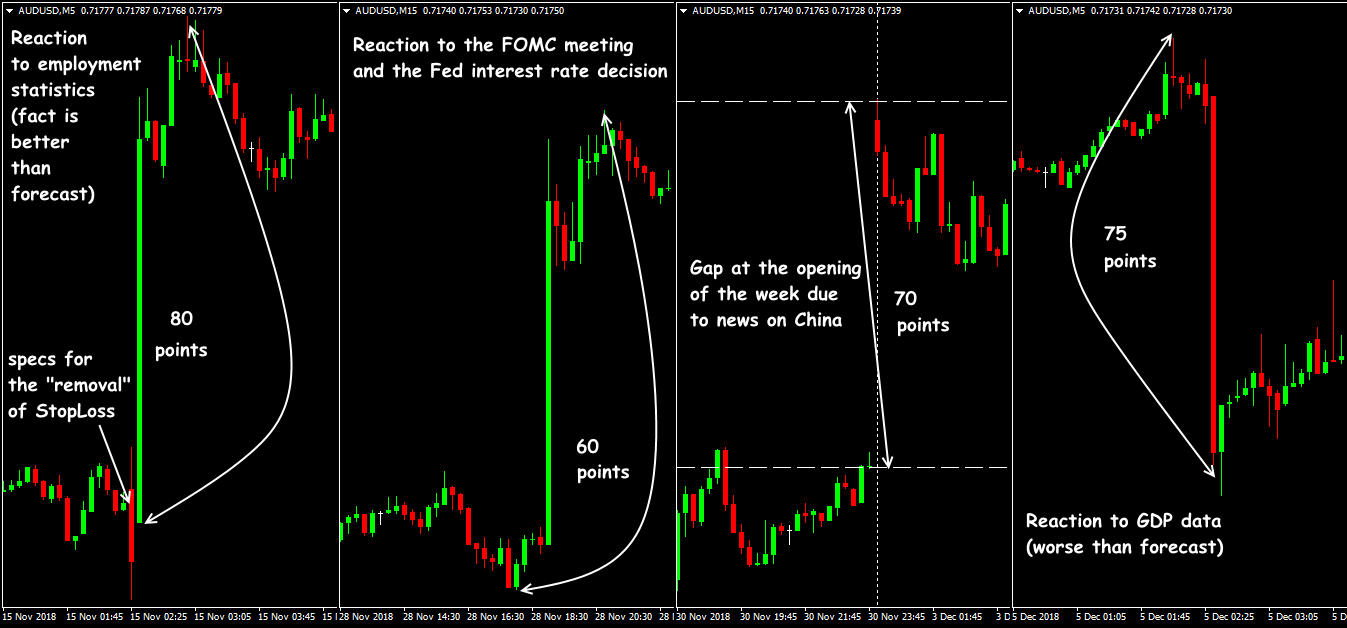

Ozzy is one of the riskiest assets for news trading; regular insider information is thrown into the market 2-5-10 minutes before the publication of statistics or the RBA decision. Even there are precedents for the investigation of exchange manipulations with information leakage on the millions there.

The usual thing is the removal of Stop Loss on both sides of the market right before the news, so those who work on a bunch of BuyStop/SellStop orders should be extremely careful. If the statistics consist of several indicators that show deviations in different directions – the market reaction is minimal.

Nevertheless, after the first throw, the main pair AUD/USD, as well as the cross AUD/JPY, gives a steady movement in the direction of deviation from the forecast. The reaction to the statements of the RBA is usually weak; the comments of the Central Bank head cause the strong throws extremely rarely. The interest rate has not been changing for more than two years, and if such occurs, any information on this issue is processed by the market in advance.

AUD/USD gives an excellent reaction to NFP, sometimes even better than the euro, and with no delay. Aussie reacts extremely nervously to China’s economy.

Features of trading strategies

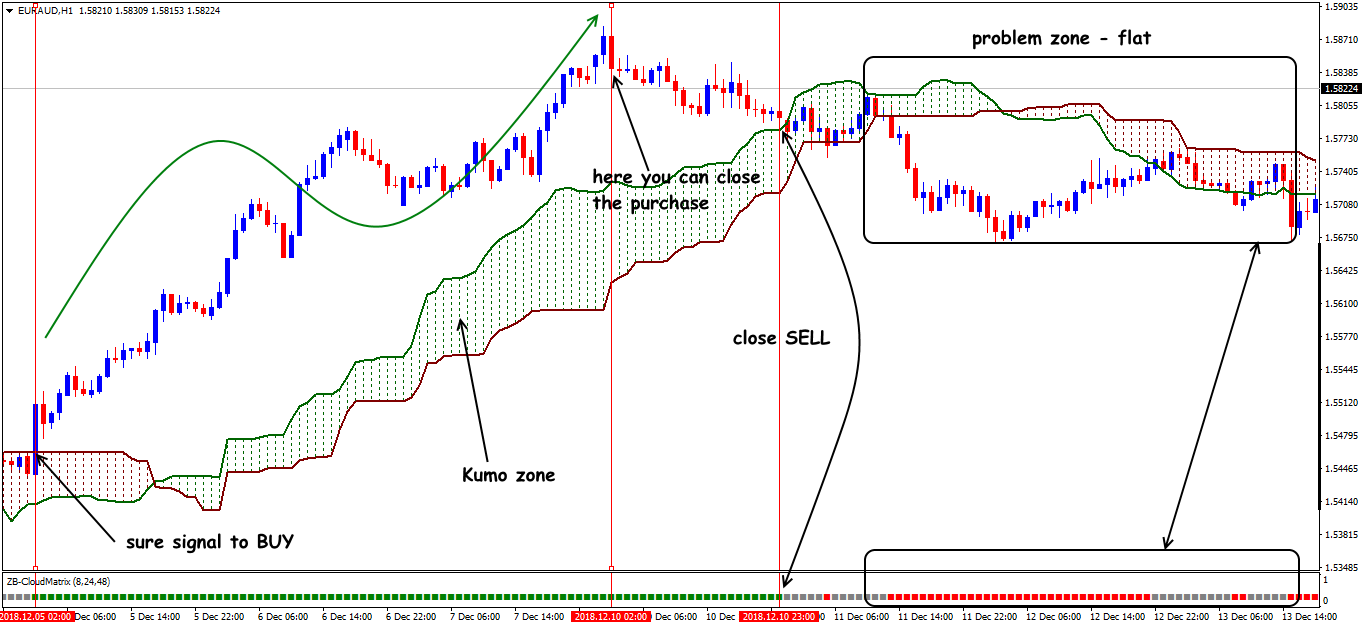

On assets involving AUD, classic trending strategies are a priority, and the simpler, the more reliable. Fans of multicurrency trading can pay attention to joint work with assets XAU/USD, USD/CAD, AUD/CAD, EUR/AUD, USD/JPY.

If you have the skills of fundamental analysis, we can recommend you not only AUD/USD but also EUR/AUD – it is most actively changing along with the price of gold. The uptrend for the AUD/USD pair is slightly ahead of the downtrend for the EUR/AUD pair, and the dynamics of gold only strengthens the current trend.

Sources of information and useful links

- The World Factbook; Australian Bureau of Statistics;

- Public datasets from Government; Prime Minister of Australia;

- Economist; The European Australian Business Council;

- Australian Trade and Investment Commission; Parliament of Australia;

- Australian Property Investor magazine; Australia and New Zealand Banking Group;

- Reserve Bank of Australia; Australian Stock Exchanges; Australian Parliamentary Library.

A few practical notes

At the beginning of my trading path, I was forced to trade precisely in the Asian session. What is the result? Today I am very grateful to the classic AUD/USD pair for the trading experience and the first stable profit.

The Australian dollar is an ideal asset for intraday or medium-term trading, but not for scalping: speculation on the Aussie requires special care, but it can also be very profitable with strict money management.

AUD assets are recommended to technically trained beginners with small deposits and reasonable ambitions, and the abundance of fundamental information affecting the Australian dollar only encourages the trader to constant self-development.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

The testing of this feature was arranged in Forex Tester with the historical data that comes along with the program.

To check this (or any other) feature’s performance you can get Forex Tester Online.

In addition, you will receive 23 years of free historical data.

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska