The popular book of the successful analyst and trader Thomas R. DeMark «The New Science of Technical Analysis» was carefully read by few. But practice proves: those who have not regretted the time to study his theory, will always be in profit.

The author created his own technical tools even before the era of the computer revolution − at that time analysts performed most of the calculations manually. That is why the indicator DeMarker can boast a simple logic, but at the same time it effectively evaluates potential price extremes, which, first of all, is profitable for us − active speculators at the Forex market.

So let’s begin.

Logic and purpose

Initially, the author (Thomas R. DeMark) wanted to make the optimal oscillator − without the usual drawbacks − as a result, its indicator DeMarker provides a minimum lag among all the instruments of this type.

The main idea is to identify not only the traditional overbought/oversold zones on market, but also the areas of the «price depletion» in which local max/min are most likely to be formed. The calculation mechanism evaluates the direction of the trend by the means of a rather cunning comparison of the current bar’s max/min with the analogous extreme of the previous bar, and, in addition, it carries out an additional assessment of the risk’s degree for the conclusion of the transaction.

Scheme of the DeM indicator’s signals

As a result, a turn from this area of the «exhaustion» is more reliable. Using longer periods of the calculation allows you to monitor confidently the long-term trend; short periods allow you to open a trade at a point with a minimum risk level.

Calculation procedure

The formula for the indicator DeMarker calculation is very similar to the calculation of a well-known indicator RSI.

First, the price difference High (parameter DeMax) and Low prices (parameter DeMin) for the current and past bars are calculated. Further, if the result obtained, respectively, is greater (or less) than the current values, then it will be taken into account when calculating the totals.

On each interval (i) the following actions are performed:

DeMax(i) is calculated.

If High(i)>High(i-1), then DeMax(i)=High(i)-High(i-1); otherwise − DeMax(i)=0.

Similarly, we calculate DeMin(i).

If Low(i)< Low(i-1), then DeMin(i)=Low(i-1)-Low(i); otherwise, DeMin(i)=0.

Next, the total value of the moving average is calculated and divided by the sum of the values of the maximum and minimum moving averages. Like that:

DMark(i)=SMA(DeMax,N)/(SMA(DeMax,N)+SMA(DeMin,N))

where:

- High(i) − maximum price of the current bar;

- Low(i) − minimum price of the current bar;

- High(i-1) − maximum price of the previous bar;

- Low(i-1) − minimum price of the previous bar;

- SMA − simple moving average;

- N − number of the periods to calculate.

Comparison of the extreme prices for the several previous periods increases the sensitivity of the DeMark indicator and reduces the risk of a wrong decision. From a market perspective, this method of the calculation most effectively takes into account the current DeMand for the asset.

Parameters and control

The indicator line of the DeMark (traditionally for the oscillators) is located in an additional window under the price chart. The range of the indicator DeM values ranges from 0 to 1 (or 0-100%), with critical zone levels of 30/70 (20/80 − sometimes used for very volatile assets such as gold, silver, oil).

Standard version of the indicator DeMark

It is assumed that when the indicator line falls below the level of 30 − the market is oversold − the price is expected to turn up; if it rises above the level of 70 − the market is overbought − we are waiting for a downward turn.

Except the color scheme, only one parameter – the averaging period is used (or number of bars for the calculation).

If you reduce the calculation period, the line turns out to be more sensitive, but reliability of the signals is lost. If you increase the averaging parameter, then the indicator DeMarker will display more global price movement, but the trade signals will be late. The market’s picture turns out absolutely different after changing the parameter of the indicator.

A long and short period in the DeMarker

DeMark offers parameter 13(14) and author didn’t leave any tips about trading on timeframes below D1. However, for the Forex market, the H1 timeframe is considered to be the minimum period on which signals of the indicator DeMarker can be trusted. It is possible to use several versions of the indicators: for a short-term and long-term trend.

Let’s look at it in detail.

Trade signals of the indicator

Author’s interpretation suggests to divide the signals of indicator DeMarker into 4 groups:

- Behaviour of the line in critical areas (overbought/oversold).The usual logic: output in the zone above 0.7 (70) − wait for max and turn down; in the area below 0.3 (30) − wait for min and move up.

Transactions open in the direction of the indicator’s turn: a breakdown of level 70 down − SELL, level 30 up − open a purchase (BUY).

This DeMarker indicator’s signal is considered to be strongest.

- Divergence of the price and indicator line (double/triple).Bullish divergence is the signal of a downward trend. Bearish divergence is a signal of the growth. Triple divergence − is a strongest signal.

Trade schemes of the divergence and a turn on DeM

- Breakdown of the support/resistance line on the indicator.

Breakdown of the «trend» line, constructed by max/min indicator line, serves as a strong signal to buy/sell in the direction of the breakdown.

- The appearance of the graphic patterns on the oscillator line.

Such signals are processed according to the standard scheme (Triangles, Head-Shoulders), but the accuracy of such patterns is much lower than similar figures on the price chart.

It is considered to be the weakest signal of DeMarker indicator. Nevertheless, in the most cases they signal about the forthcoming breakthrough on the price chart.

We remind: the DeMark indicator confidently estimates volatility of an asset, therefore its movement between critical levels can be considered as an obvious indicator of a flat. What this means is: That even implicit or conflicting signals of the indicator are considered to be the key points for a kickback start

Application in trade strategy

The main drawback of the DeMarker indicator is a large number of the false signals in the opposite direction, if at the same time there is a strong trend at the market.

Trading signals of the DeM indicator

At the same time, if a strong trend is formed, but without stable volatility (price shots + short consolidation periods), then the indicator line «hangs» in middle zone.

DeMarker: problem situations

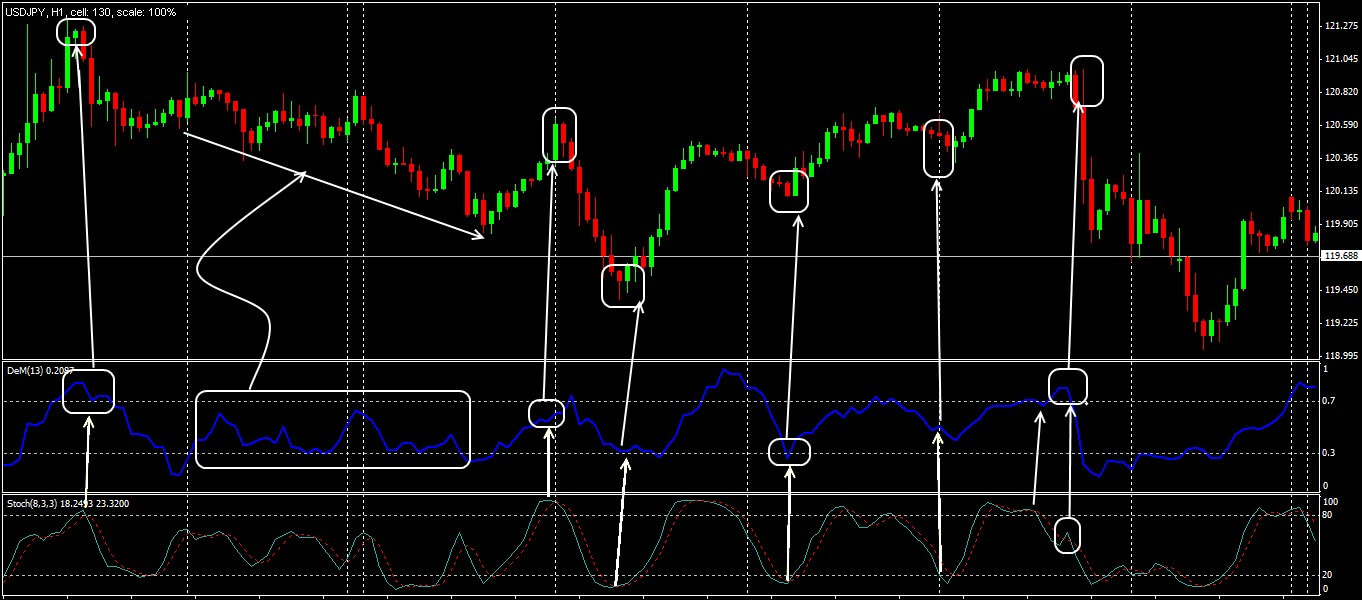

The DeM indicator filters the market noise well, but the systems that use the standard Stochastic as an additional tool are considered more stable:

DeMarker+Stochastic: scheme of the trading signals

If you use DeMarker complete with any trend indicator, for example, long and short moving averages, you can get excellent leading signals and weed out the majority of the «false points».

DeMarker+SMA: moving averages as a base trend

The result?

It is not recommended to trade only on the signals of the DeMark indicator or use it as the base of a trading strategy. The confirmation from additional oscillators, trend instruments or candlestick analysis is necessary.

Several practical remarks

Indicator DeMarker allows you improve the efficiency of the trades at the turn of the trend to the level of 65-90%, but!

Shortcomings, traditional for oscillators, are characteristic of this indicator: it gives the excellent signals during the periods of a trade range, if the cycle of the trade range corresponds to the parameter of the oscillator, and gives false signals if this cycle doesn’t correspond to the length of the indicator or if the strong trend begins.

When the «strong» local extremum is detected, confirmed by the large market volumes, the indicator can generate signals opposite to the current trend, so you need to be careful. The reasonable use of the DeMarker indicator significantly reduces the risk of any trading strategy.

Try It Yourself

After all the sides of the indicator were revealed, it is right the time for you to try either it will become your tool #1 for trading.

In order to try the indicator performance alone or in the combination with other ones, you can use Forex Tester with the historical data that comes along with the program.

Simply get Forex Tester Online. In addition, you will receive 23 years of free historical data.

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska