When approaching market trading, understanding the difference between fundamental analysis vs technical analysis is essential. The first focuses on price charts, indicators, and patterns to forecast future movements, while the second studies economic data, interest rates, and news to understand what drives those movements.

While each method serves distinct purposes, savvy traders often combine them to gain a fuller picture and improve their decision-making. This article breaks down key differences, explores strengths of both types, and introduces Forex Tester Online – a powerful tool to practice and refine your technical analysis strategies before risking real capital in live trading.

What Is Fundamental Analysis?

Fundamental analysis looks at what a business is really worth beneath the chart. It studies economic conditions, company finances, and qualitative factors to judge the true value of a security. An analyst reviews income statements, balance sheets, cash flow, management quality, and competitive position in the market, then compares that picture with the current price. If the market price sits far below this estimated “intrinsic value,” the stock or other asset may be a candidate for long-term Investments; if it sits far above, it may be overpriced and riskier to hold.

Unlike technical analysis, it studies real-life factors, not chart trends. We will talk about the difference in detail a little bit later.

In practice, fundamental analysis starts with the core financial statements:

- Income statement – shows revenue, expenses, and profit. It tells you how efficiently the business generates earnings.

- Balance sheet – lists assets, liabilities, and equity. It shows how stable and solvent the company is.

- Cash flow statement – tracks money coming in and out. It reveals whether profits are backed by real cash, not just accounting.

By studying these reports over several periods, investors can judge the quality of earnings, debt levels, and the company’s ability to survive downturns. They also look at margins, return on equity, and growth rates to see how the business stacks up against peers in the stock market and wider financial markets.

The key idea is simple: compare intrinsic value to the current market price. If the stock trades below its estimated value, it may be undervalued and attractive for long-term investments. If it trades far above, it may be overvalued and risky, especially when macro conditions worsen. This framework supports more systematic risk management because decisions rely on data, not headlines.

Fundamental analysis also includes macro factors: interest rates, inflation, GDP, employment data, sector trends, and regulation. These elements can change how cash flows are valued and which industries are likely to do well. For example, defensive dividend stocks may look safer when growth slows, while highly leveraged companies can suffer when rates rise.

This method works best for:

- Blue-chip stocks with long earnings history and stable dividends.

- Dividend stocks where payout safety depends on cash flow strength.

- IPO analysis, where investors must judge if the offer price is fair versus the company’s business model and prospects.

- Sector rotation decisions, such as shifting from cyclical to defensive names based on the economic cycle.

While technical analysis focuses on price patterns and chart signals for trading decisions, fundamental answers a different question: Is this business strong enough and cheap enough to own for the long term? Many traders and investors start with fundamentals to build a watchlist of quality assets, then time entries and exits with technical tools.

Key components of Fundamental Type of Analysis

- Economic analysis. Study GDP, inflation, interest rates, and unemployment to see where the economy stands and how Financial Markets may react.

- Company analysis. Read income statements, balance sheets, and cash flow reports, plus key ratios and debt levels, to judge financial health.

- Qualitative factors. Look at the business model, brand, management, and competitive position in the stock market.

- External factors. Factor in regulation, technology shifts, and geopolitical risks that can change future cash flows and investments.

Pros

- Finds intrinsic value. Helps spot undervalued or overvalued stocks by comparing market price to estimated fair value.

- Supports long-term investing. Fits investors who hold positions for months or years and care about business strength, not intraday trading noise.

- Deeper understanding. Builds a clear picture of earnings quality, management, and the firm’s ability to survive downturns.

- More disciplined decisions. Numbers and ratios reduce emotional decisions and support structured risk management.

Cons

- Takes time. Proper fundamental analysis means reading reports, sector research, and macro data.

- Partly subjective. Judging management, brand power, or future growth always involves opinion.

- Weak for short-term trades. It does not capture quick price swings. Technical analysis and price patterns are better there.

- Backward-looking data. Past statements may miss new risks or sudden regime shifts.

- Market can stay irrational. A “cheap” stock can remain cheap for a long time, so returns may take time to show.

- Data quality risk. If reports are inaccurate or manipulated, the whole analysis can be flawed.

What is Technical Analysis?

Technical analysis is a trading method that uses historical market data – mainly price and volume – to forecast future price movements. Instead of asking what a company is worth like fundamental analysis does, it asks how buyers and sellers behave on the chart. Traders study price patterns, chart patterns, and technical indicators to find trends, reversals, and precise entry and exit points in the financial markets.

Technical Indicators

- Moving Average. This is a tool that allows you to assess the mean price of the asset over the course of a specific time period which is a good way to understand the nature of the current trend.

- Alligator. This is basically a set of moving averages that will help you to understand the relative strength of a trend on the shorter timeframes against the strength of the long-lasting trends.

- Relative Strength Index. This is a great tool to understand the momentum of the trends and their changes within a certain timeframe.

- MACD is based on two MAs. This tool helps you to understand how the market really works in the long run.

Please, note: in our blog there are numerous articles about indicators including their settings, strategies and trading set ups. Read the detailed article about Awesome Oscillator, for example, or the Alligator Indicator, as well as many others.

Also read: TOP-21 Technical Indicators for traders

Other key tools in Technical Analysis

- Volume. Shows how many shares or contracts traded in a given period. Strong moves in the stock market or other Financial Markets backed by high volume are more likely to be real than thin, low-volume spikes. Many traders use volume to confirm breakouts from chart patterns or key levels.

- Momentum indicators. These technical indicators measure how fast the price is moving. They help you see whether a trend is picking up speed, slowing down, or about to stall. RSI, MACD, and stochastic are common tools here. They work well with price patterns and trendlines to time entries and exits.

- Oscillators. Most momentum tools are oscillators, moving between fixed bounds (for example, 0-100). They help spot overbought and oversold zones, possible reversals, and short-term exhaustion. Used with support and resistance, they can improve risk management by avoiding entries into already stretched moves.

Pros and cons

Technical analysis gives traders structure and speed. It reads the tape directly through price and volume, without digging into balance sheets or earnings reports. That makes it popular for short-term Trading and active investments in Forex, crypto, and the stock market. But it also has weak spots: signals can fail, charts can be read in many ways, and it often ignores fundamental news.

Pros

- Fast decisions. You work with live charts, price patterns, and technical indicators only. This lets you react quickly when markets move, which is crucial for intraday and swing Trading.

- Defined rules. Clear entry, exit, and stop-loss levels can be built around Chart Patterns, support/resistance, and volatility. This supports more disciplined risk management and reduces random clicks.

- Works on almost anything. The same toolkit can be applied to Forex, stocks, indices, commodities, and crypto, across any timeframe from 1-minute scalps to weekly trend trades.

- Low entry barrier. With basic charting software, you can start reading charts without a finance degree. Most platforms give you standard technical indicators out of the box.

- Price-focused view. TA assumes that all known information is already reflected in price. Traders skip the accounting details and focus on raw supply and demand.

Cons

- Room for interpretation. Two traders can look at the same chart and see different things: one spots a bullish flag, the other sees a topping pattern. This subjectivity can hurt consistency.

- False signals. In choppy markets, many breakouts fail and many indicator crossovers whipsaw. Without strict risk management, a trader can take a series of small but painful losses.

- Blind to fundamentals. Pure TA ignores earnings, interest rates, and news. A strong setup on the chart can collapse in seconds after a surprise report or policy decision.

- Based on the past. Technical analysis assumes that past behavior repeats in some form, but regimes change. Low-rate environments, crises, and new regulations can all make old patterns less reliable.

- Weaker for very long-term investing. For multi-year investments, fundamental analysis usually gives a better picture of business quality and cash flows. TA works best as a timing tool layered on top of that, not as the only filter.

The comparative analysis becomes too complicated and makes you put in the titanic efforts to make a good assessment of the current situation.

Its core belief is simple: history tends to repeat itself, and price movements often follow recognizable patterns. This makes technical analysis especially useful for short-term trading, where quick, data-driven decisions matter most. It adapts easily to volatile markets – like Forex, crypto, and meme stocks markets – and allows traders to act without waiting for new economic data.

Technical vs Fundamental Analysis Differences

In the financial markets, every trader and investor relies on some form of analysis to make informed decisions. The two dominant schools of thought — Fundamental Analysis and Technical Analysis — approach the market from opposite directions. Fundamental Analysis studies the underlying economic and financial factors that determine the intrinsic value of an asset, while Technical Analysis focuses on price patterns, volume, and chart behavior to predict future movements.

Understanding how these two methods differ helps clarify which one fits your trading or investment goals, and how you can combine them with tools like Forex Tester Online to strengthen your risk management and test real strategies.

| Factor | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Core Definition | A method used to estimate the fair value of assets by studying economic, financial, and geopolitical factors. | A method based on analyzing price charts, volume, and technical indicators to identify trends and market psychology. |

| Main Focus | Company or country’s economic strength, earnings, interest rates, monetary policy, and growth potential. | Price action, support and resistance levels, chart patterns (like Head and Shoulders or Double Top), and momentum indicators. |

| Data Sources | Financial statements, balance sheets, income reports, central bank data, inflation, employment, and trade balances. | Historical price data, candlestick charts, trading volume, and tools such as Moving Averages, RSI, MACD, and Bollinger Bands. |

| Analytical Foundation | Rooted in economics and finance theories like the Capital Asset Pricing Model (CAPM), Efficient Market Hypothesis, and valuation models (DCF, P/E). | Based on Behavioral Finance and crowd psychology — assuming market participants react similarly under recurring conditions. |

| Key Assumption | Market prices may deviate from intrinsic value in the short term but always revert in the long term. | All available information is already reflected in price; history tends to repeat itself through recognizable patterns. |

| Time Horizon | Long-term perspective — ideal for investments held for months or years. | Short- to medium-term focus — ideal for day trading, swing trading, and scalping strategies. |

| Primary Tools | Economic indicators (GDP, CPI, interest rates), company earnings, management reports, and industry comparisons. | Technical indicators (Moving Averages, RSI, MACD), trendlines, chart patterns, Fibonacci retracements, and volume studies. |

| Market Conditions | Works best in stable or recovering economies where fundamentals dominate price movement. | Excels in volatile or trending markets, including Forex, crypto, and stock market. |

| User Base | Long-term investors, analysts, portfolio managers, and institutional funds. | Active traders, scalpers, and short-term speculators seeking quick market reactions. |

| Risk Management | Relies on diversification, position sizing, and valuation-based entry points. | Relies on stop-loss, take-profit, and position sizing based on volatility and trend strength. |

In essence, Fundamental Analysis tells you what to buy or sell, while Technical Analysis shows you when to act. Many professionals combine both: they use fundamentals to filter strong assets and technicals to find precise entry and exit points.

Modern platforms like Forex Tester Online let traders practice and backtest their technical analysis methods — including Moving Averages, support and resistance, and price patterns — across real historical data. This practical testing bridges theory and execution, helping traders refine their risk management and trading discipline before facing live financial markets.

Using Both Types of Analysis

Fundamental and technical analysis don’t have to be viewed as opposites – the most effective traders often combine them into a hybrid strategy. In this approach, fundamentals define what to trade, and technicals determine when to act.

You can use them this way:

- Use extensive fundamental analysis to assess a market situation and make general predictions.

- Use technical analysis to either confirm your estimations or get a second opinion.

- With various TA techniques, identify possible quantitative changes (i.e. how much the price can move).

Start with fundamental analysis to identify strong assets – companies with solid earnings, stable balance sheets, and growth potential. This helps filter out weak opportunities and focus on high-quality stocks or currencies supported by real economic strength.

Then apply technical analysis to fine-tune your entries and exits. Use tools like Moving Averages, support and resistance, or momentum indicators (RSI, MACD) to spot favorable price zones and confirm timing. For instance, if you expect a stock to rise after a product launch, technicals help estimate the best moment to enter and set take-profit or stop-loss levels.

Today, AI-driven tools for traders and real-time market data make this hybrid approach even more effective. Algorithms can scan thousands of assets, analyze price behavior, detect chart patterns, and integrate fundamental metrics instantly. Platforms like Forex Tester Online allow users to backtest and refine these combined strategies – merging human judgment with algorithmic precision for smarter, data-based decisions.

Which Analysis Works Best?

It depends on three things: risk tolerance, investment horizon, and market conditions.

- Low risk + long horizon? Study fundamental analysis: earnings quality, balance sheet strength, cash flows.

- Higher risk + short horizon? Then learn Technical Analysis: trend, momentum, support/resistance.

- Market regime matters. In clear trends/volatility, technicals shine; around regime shifts (rates, earnings, policy), fundamentals lead.

But, as we said before, they are not the opposite. These two types can work together.

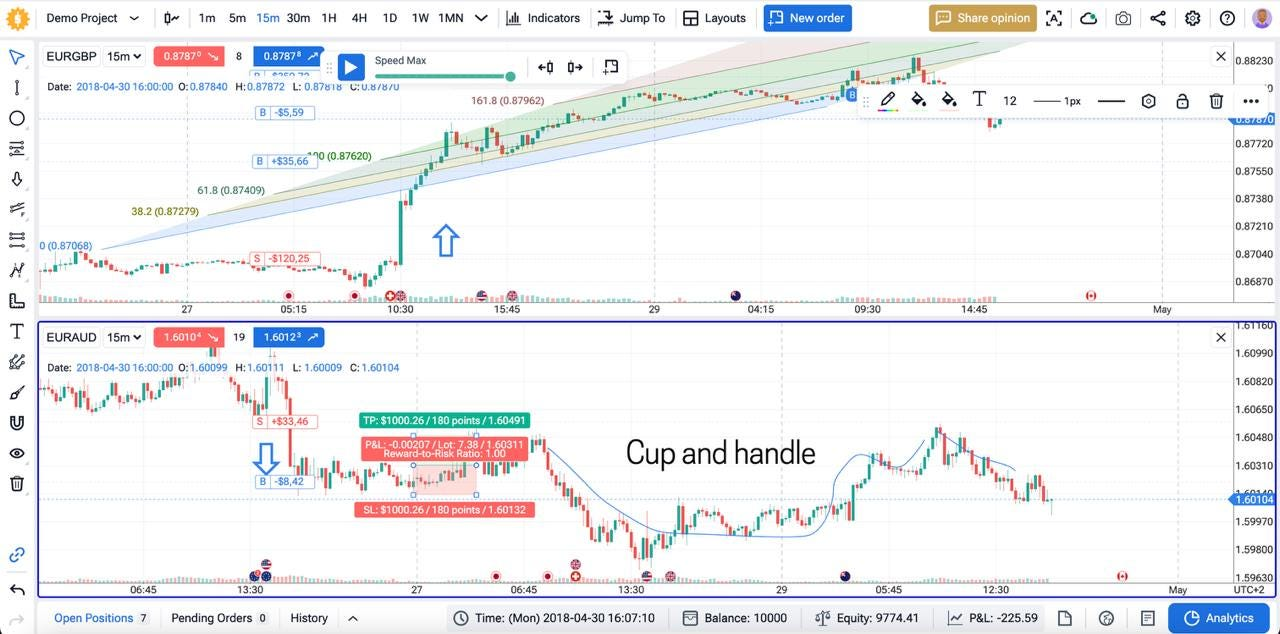

Improve Technical Analysis of Your Trading Strategies via Backtesting

The Forex Tester Online strategy backtester lets you combine both analysis styles in one setup. Its integrated news calendar allows you to test reactions to rate changes, CPI, NFP, or earnings events, tag trades by event type, and compare results before and after major announcements.

For technical analysis, it provides a wide range of indicators like Moving Averages, RSI, MACD, and Bollinger Bands, plus tools for support/resistance and trendlines. The Blind Mode hides future bars for realistic testing, while Jump-to-Signal and multi-chart layouts make it easy to spot and refine your trading setups.

Why backtest here

✅ 20+ years of tick data across Forex, crypto, indices, stocks, ETFs, and commodities.

✅ Manual or automated runs; AI analytics and automations on Pro plans.

✅ Detailed stats: win rate, payoff, drawdown, MAE/MFE, equity curve, latency logs.

✅ Build and verify risk management: stops, targets, position sizing.

Conclusion

Technical and fundamental analysis serve different roles but work best together. Fundamentals help you choose what to trade; technicals help you decide when to act.

Define your goals, risk, and horizon. Blend both methods to fit your plan, then prove the rules. Backtest your ideas in Forex Tester Online before putting real money at risk.

FAQ

Which platform is best for trading technical analysis?

We recommend Forex Tester Online as an advanced backtesting tool.

Which analysis is best for beginners in trading?

Technical is usually the best starting point because it’s easier to learn and apply. Price charts, indicators, and simple support and resistance levels help beginners understand market behavior quickly. However, to grow as a trader, you’ll eventually need to study fundamental analysis too — it explains why markets move and helps you make stronger long-term decisions.

To which assets can technical analysis be applied?

Technical works across almost all financial markets, including Forex, commodities, stocks, and crypto. Since price patterns and market psychology repeat everywhere, the same tools — such as Moving Averages, RSI, and MACD — can be used to backtest and trade any of these asset classes in Forex Tester Online.

Forex Tester Online

Get technical analysis experience without risking real money

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska