According to analysts, about 670 million people in 45 countries use EUR as a monetary asset. The euro, along with the US dollar, makes up the bulk of the entire currency supply in market circulation. In addition to spot assets, all derivative financial instruments are traded for the main European currency: CFD, currency futures, options, and European stock indices. The euro movement and correlation remain an indicator of market conditions in most trading instruments.

Whatever you trade, it is impossible to avoid “communication” with the euro in the modern market and not to consider its influence.

Currency history and basic parameters

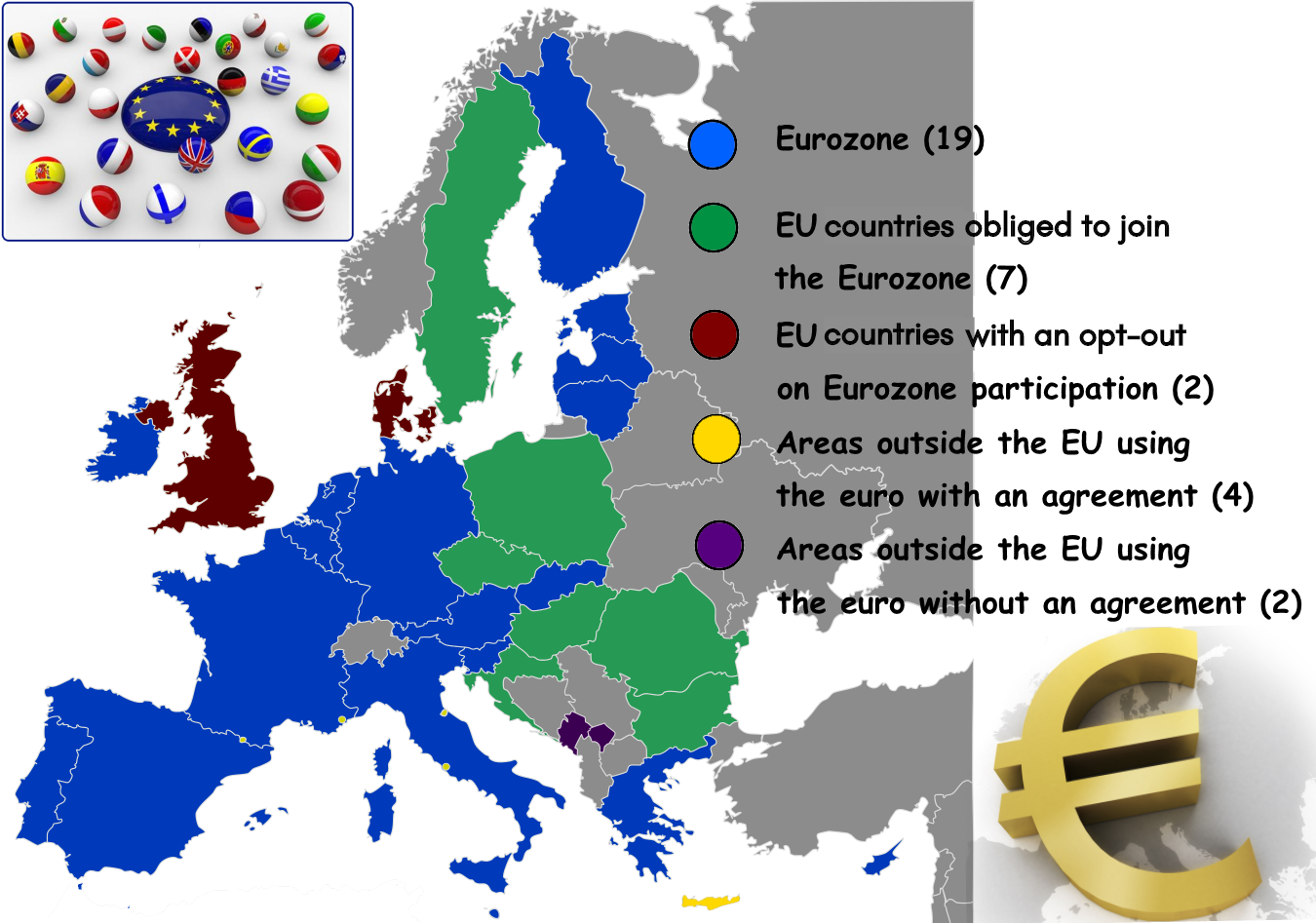

The euro (€, EUR) belongs to the type of collective currencies and performs the task of a single means of payment in the Eurozone − a monetary union within the EU.

Back in 1979, the EEC created the European Monetary System, which combined the mechanism of the floating exchange rate of European currencies with the conventional unit of account − ECU.

The history of the euro begins with «Delors Report», prepared in 1988 by a group of specialists led by the President of the European Commission, Jacques Delors. EU countries had to completely abolish the restrictions on the movement of capital within the union and unite financial markets. Formally, the creation of a common currency authorized the Treaty on European Union, signed in February 1992. Thereat the European System of Central Banks was formed (National Central Banks + European Central Bank). Subsequently, the EU countries transferred to the ECB all powers in the field of monetary policy, including decisions on the size of the banknotes’ issue and the level of the key interest rate.

EUR: area of use

Officially, the euro appeared in non-cash payments on January 1, 1999, and on January 1, 2002, banknotes and coins were put into cash circulation. However, the parallel circulation of national banknotes with euro continued for another two months. Full transition to the euro as a sole means of payment was made on June 1, 2002.

Features of fundamental analysis

Effective analysis of the euro (in particular, EUR/USD) is possible thanks to a vast amount of information, statistics and analytics. EUR trading assets actively cover any political instability of the Eurozone and the USA, the situation in the commodity market, the activities of European and American banks, etc. Therefore, the fundamental analysis should take into account:

- official statistics, economic data and an assessment of the political situation of the Eurozone and the USA;

- statements of officials and key market participants in the Eurozone and America;

- features of the monetary policy of the ECB and the Fed, any official (and not only!) information of regulators and statements of financial figures;

- the dynamics of European stock indexes (FTSE 100, DAX, CAC 40), reporting of large corporations, the dynamics of prices for energy resources, raw materials and essential goods;

- regarding the aggressive US customs policy − the situation with China and the region of Southeast Asia.

Monetary policy and regulation

The work of the ECB remains the most influential fundamental factor for EUR. Since January 1, 1999, the European Central Bank became responsible for the currency turnover of the Eurozone, regardless of whether a particular country has adopted the euro as the main currency or been working on the national currency unit. The main tasks of the ECB:

- implementation of the monetary policy of the euro;

- management of official financial reserves of EU countries;

- conduction and control the euro issuance;

- determination of key interest rates;

- ensurance of the price stability in the Eurozone;

- advising the Council of Europe and EU governments on banking issues.

The ECB is independent of all other EU bodies, although the European Parliament and heads of state approve the leadership of the bank. Bank meetings are held twice a month on Thursdays.

Annual and quarterly reports are of speculative interest, as well as the first monthly meeting, which assesses the current economic situation, and makes decisions on interest rates.

Another factor that could affect the EUR/USD rate is 10-year treasury bonds. Usually, German 10-year bonds are used. Necessary information and current statistics can find here.

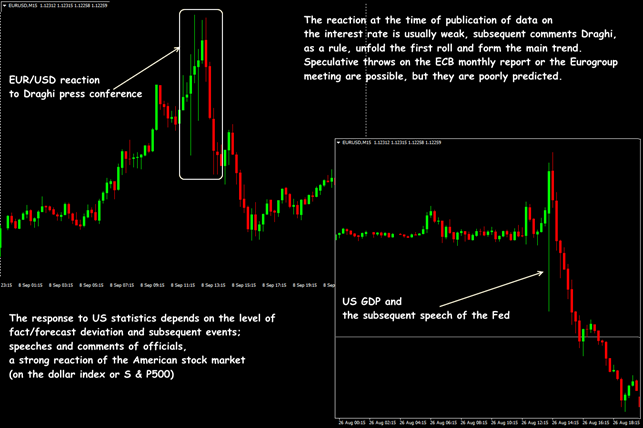

EUR/USD in periods of speculation

Currency interventions (both hidden and official) are not used by the ECB; the most potent price drivers are the speeches of the ECB head (now – Christine Lagarde). The market almost does not react to the comments of other leaders, except for the statements by the head of BOE (Mark Kearney), the German chancellor and the chairperson of the Bundesbank. Any political or economic problems of the EU countries and the Eurozone as a whole provoke short-term movements in EUR/USD.

After the 2008 crisis, the ECB lowered the basic discount rate to 0.5%, and since August 2016, it has been pursuing a policy of zero and negative interest rates. The quantitative easing program (EuroQE) lasted for 4 years. The total amount of the bond redemption reached €2.6 trillion ($2.96 trillion) and was completed in December 2018.

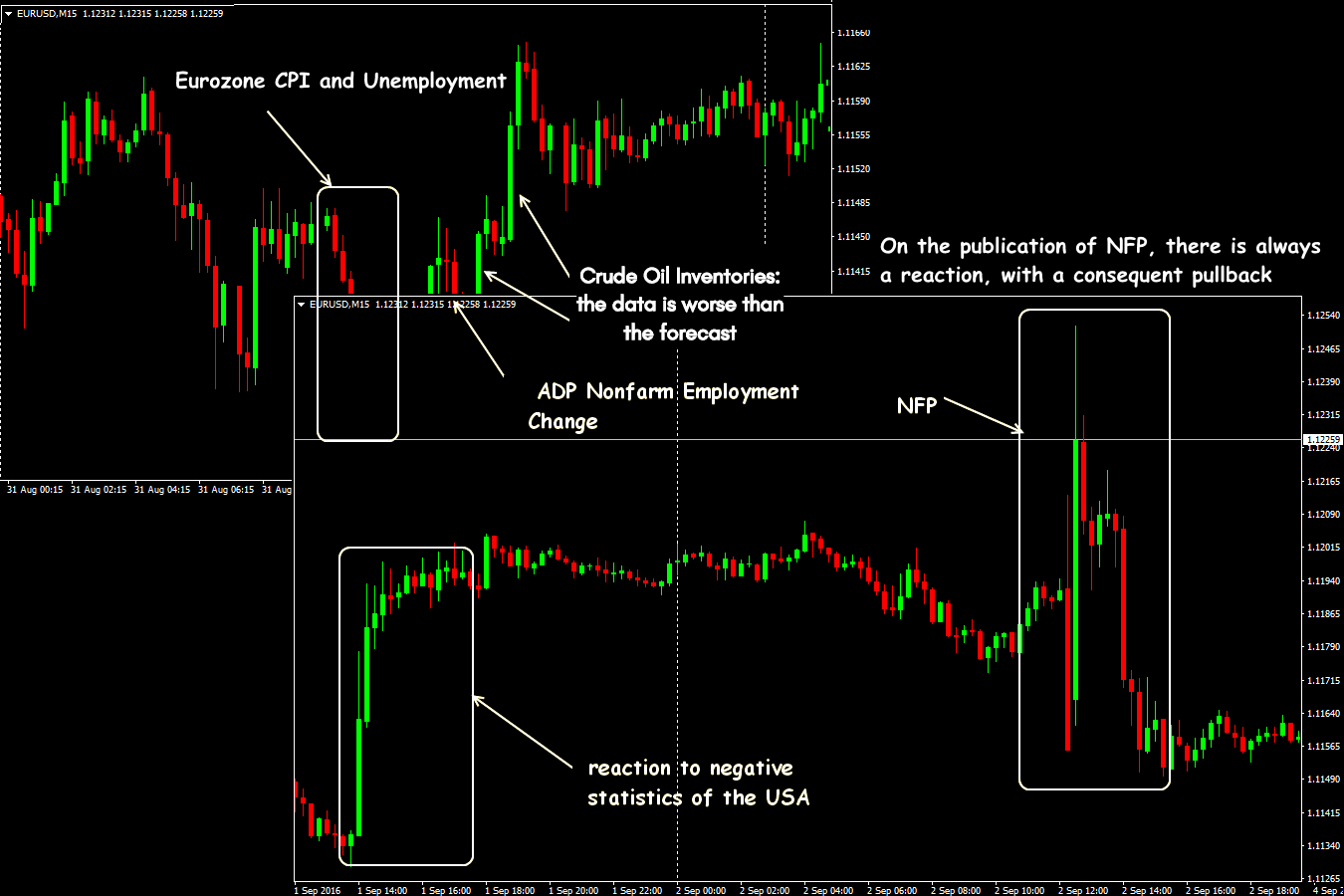

Trading on the news

Below are presented the base indicators of Europe and the United States in the order of decreasing impact on the dynamics of the base pair EUR/USD:

- Central Bank news, parameters and problems of monetary policy, in particular, the dynamics of the EU, US, UK and Switzerland interest rates;

- GDP: the Eurozone, the USA, the EU, Germany, England, France, Italy;

- labour market indicators (unemployment and wages);

- inflation rates;

- production statistics (purchasing and producer price index (PPI), industrial output);

- consumption indicators (CPI, consumer confidence index, business climate, PMI business activity index);

- financial performance (private-sector lending, consumer lending);

- trade indicators (indices of retail and lower prices, trade balance, retail sales);

- financial sector statistics (current account balance, monetary aggregate M1, etc.);

- crude oil reserves;

- summits and meetings of the EU, G7 and G20 leaders;

- political problems (except such as Brexit) and natural disasters.

EUR/USD: Trading on statistics

What is the result? The impact of these data on the euro is complex. The market reaction is usually formed by analysts afore publication. To «catch» the price roll by the usual methods of trading on the news is possible only at the NFP output. The reaction of commodity assets should be monitored in conjunction with the stock market. The updated assessment and revision of statistical data for the previous period may provoke a movement not only on EUR/USD but also on EUR/GBP and EUR/JPY.

Features of technical analysis and strategies

EUR/USD − the most liquid asset of the foreign exchange market − reaches 35% of the transaction volume on various forms of contracts. It means that any broker will provide you with low spreads and excellent «density» of quotes for Euro assets at almost any time.

Periods of maximum trading activity: Europe − 06-19 (GMT); Europe-America; Asia − in EUR/JPY cross.

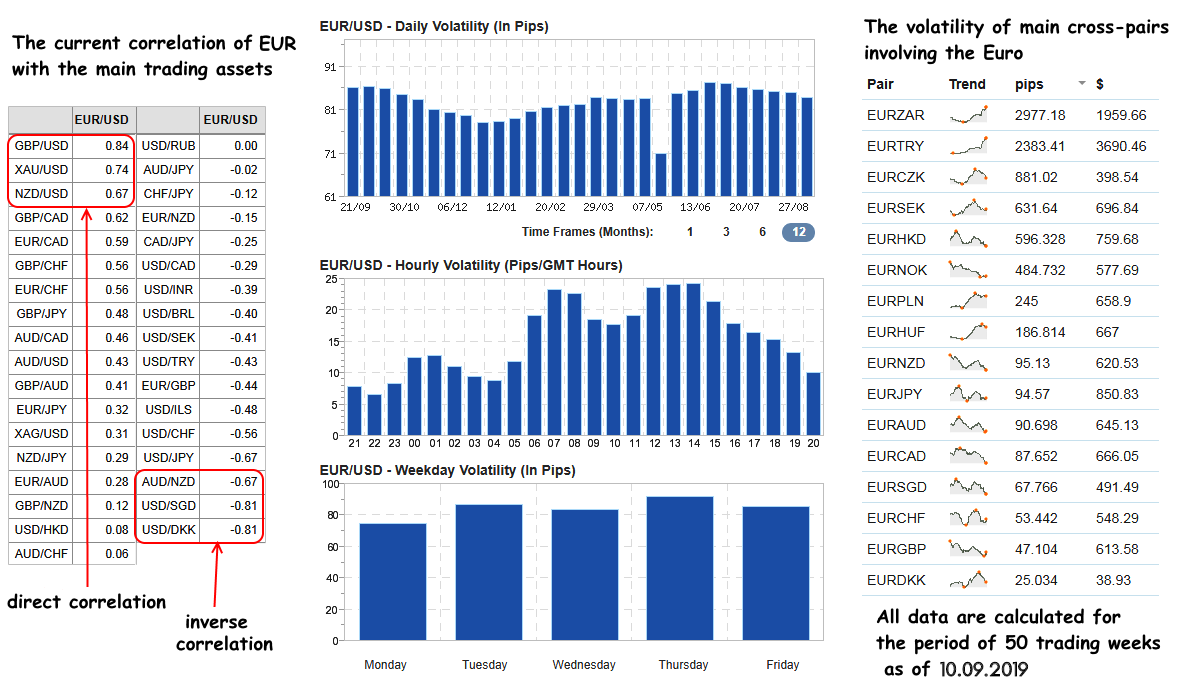

EUR: correlation and volatility

Almost all euro assets lend themselves well to technical analysis. Any trading methods work effectively on them: trend, a non-speculative channel on rollback/break, hedging and intraday scalping. However, in the middle term, the base pairs are still considered trend instruments − to change the trend for the euro, you need serious fundamental reasons.

EUR/USD: Example of trading signals

Examples of trading strategies will be discussed in the next section.

Correlation and cross-rates

First, we note two fundamental assets with which the euro has historically maintained a very strong mutual correlation.

It is gold (spot) …

XAU-EUR/USD: Correlation Analysis

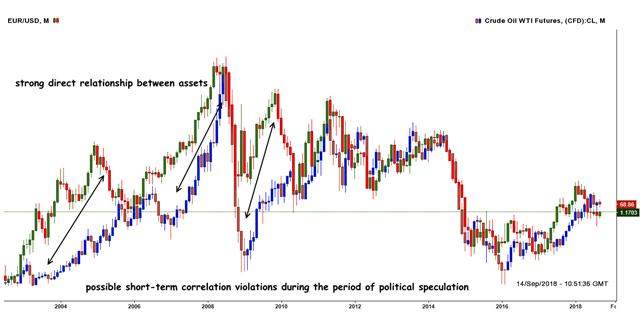

…and oil.

WTI-EUR/USD: correlation analysis

The euro firmly holds the second place among the world’s reserve currencies, and cross-assets occupy more than half of the total euro trade turnover. Therefore, understanding the peculiarities of their dynamics will add to your piggy bank several profitable trading tools.

EUR/GBP

EUR/GBP appears «historical» and the most liquid cross-rate, especially during the European session. The fact that one of the leading economies in Europe has not switched to a unified currency makes this pair unique. The impact of the American dollar is average. “Eurocable” attracts traders with its stable and predictable volatility and a convenient, «sparing» spread. Daily traffic rarely exceeds 70-80 points, but if we take into account the high cost of a EUR/GBP point, even reasonable intra-day scalping can bring a considerable profit to a trader.

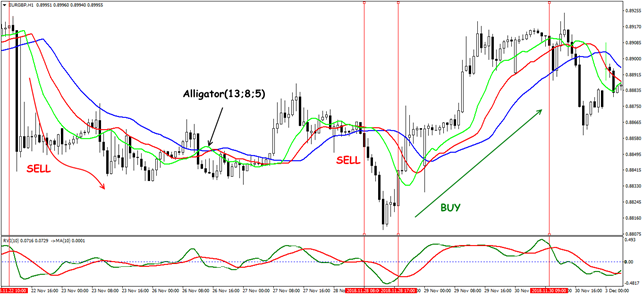

EUR/GBP: Trend Trading Signals

Before Brexit, this pair confidently copied the EUR/USD chart, but after the UK’s decision to leave the EU, the influence of the pound on the cross had intensified, and EUR/GBP began to show independent dynamics. There is no strong dependence on direct GBP/USD quotes, but speculative demand for a pound may cause price “spikes” in the EUR/GBP cross with the absence of a similar movement in the euro.

EUR/JPY

This pair estimates the correlation strength of the two strongest world economies. High volatility is provided mainly by the Japanese currency. The spread is high; the influence of the American dollar on the yen is stronger than on the euro. The EUR/JPY pair is very politicized and depends on many fundamental factors. EUR/JPY is steadily traded on medium-term strategies. It is required to conduct a fundamental analysis of adjacent markets since the cross-asset depends on the demand for Japanese goods in the European market and energy prices.

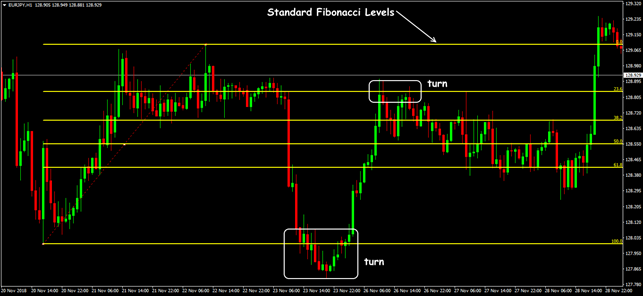

EUR/JPY: Chart of trading signals of strategy

EUR/JPY is volatile during the European and Asian sessions; speculative shots are possible on the news of Europe, Japan and the USA. It correlates well with the EUR/GBR currency pair but requires hard money management. We do not recommend trading this currency pair for beginners.

EUR/AUD

The cross rate between «political» and commodity currencies is only for mentally stable traders. High liquidity is due to the need for constant conversion of currencies in commodity contracts; scalpers (M15-H4) prefer it, although the technical analysis of this pair is poor. During the day, it responds to the euro foundation, and at night — to the news on the Australian dollar. The spread is moderate; the influence of the American dollar is weak.

EUR/AUD: a signal scheme for a scalper

A few practical notes

The euro is the optimal currency for training and reasonable trading: the spreads are low, it fully complies with technical analysis, there is a lot of vital information about it, its speculation occurs regularly, you can use classical money management. The EUR/USD test allows you to test any strategy in all variants of the market situation and the results obtained can be trusted. Those with enough practical experience and deposit can choose the euro cross-rates or exchange-based assets − there will always be opportunities for stable earnings.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

The testing of this currency feature was arranged in Forex Tester Online with the historical data that comes along with the program.

To check this (or any other) feature’s performance you can try FTO now (click the button below).

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska