Backtrader is a popular tool among algo traders, especially those comfortable with Python. But it’s not for everyone. Many users look for a Backtrader alternative because of its complexity, setup challenges, or need for easier backtesting tools. We’ve tested several competitors and picked 5 good options for different trader needs — from visual backtesting to full algo systems. Here’s our list.

What is Backtrader?

“Backtrader is a priceless tool for algotraders”. “Backtrader is a terrible tool to use”. Both are true, depending on your skills and willingness to put effort. In essence, this is an open-source Python framework for backtesting and building trading strategies. It supports live trading through brokers like Interactive Brokers and Oanda, and it includes features like strategy optimization, multiple data feeds, and a wide selection of technical indicators. It’s designed for event-driven and vectorized analysis.

But, as we said before, it isn’t for everyone. It’s entirely code-based, which can be a barrier for traders without a programming background. Setting it up also requires manual work, including data imports, broker connections, and custom plotting. That’s why many traders look for a Backtrader alternative — something similar but easier to use (or even completely different).

Let’s review the top options to replace Backtrader.

1 Forex Tester Online (FTO) – Best Replacement Option

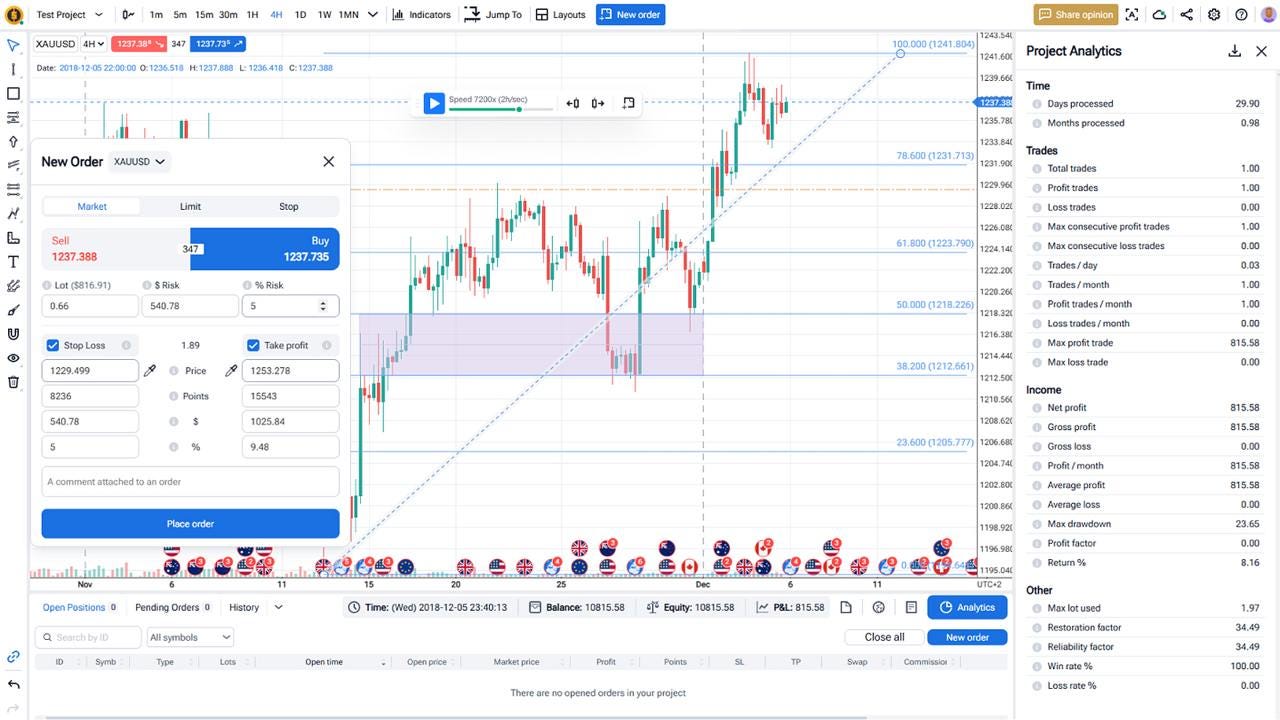

Forex Tester Online is a strong Backtrader alternative for traders who prefer a visual interface over Python coding. It’s built for manual and semi-automated strategy testing, which makes it ideal for both beginners and professionals who want accurate backtesting without writing scripts.

FTO lets you test strategies using 21+ years of tick-by-tick historical data across Forex, stocks, crypto, commodities, futures, and indices. You can manually place trades, create scenarios, and track results with built-in analytics. It includes a full trading simulator, customizable charts, and risk management tools — everything you need to backtest without code.

Key advantages:

- No coding needed

- Works in browser on any device

- Supports multiple chart layouts and timeframes

- Realistic simulation with floating spreads, commissions, and slippage

- Track results using detailed performance stats

- Advanced backtesting tools, including custom indicators, scenarios, Mystery Mode, and more.

If you’re looking for a Backtrader replacement that’s simpler, more intuitive, and fully cross-platform — Forex Tester Online is the best place to start.

👉 Try Forex Tester Online now:

2 Zipline vs Backtrader

Zipline is another Python-based backtesting framework that’s often compared to Backtrader. It was originally developed by Quantopian and is known for its clean structure and integration with Pandas. Like Backtrader, Zipline lets you create and test algorithmic strategies using historical market data.

However, many traders find Zipline outdated. The project is no longer actively maintained, and some key features are missing or require additional setup — like handling live data or certain broker integrations. It also lacks built-in plotting and advanced analyzers, which means you’ll need extra tools to analyze results visually.

Backtrader, in contrast, still has a more active user base and wider range of features, especially for simulation, live trading connections, and custom order types. But both tools require solid Python skills.

Use Zipline if:

- You want a lightweight, Pythonic backtester.

- You don’t mind managing dependencies and plugins.

But if you’re looking for an easier, supported solution, consider an alternative like FTO or Quantconnect.

By the way…

3 Backtrader vs QuantConnect

QuantConnect is a cloud-based algorithmic trading platform built on top of the open-source Lean engine. Like Backtrader, it supports Python and C#. Both platforms are made for quant traders who want to code, test strategies, and deploy them live.

Compared to Backtrader, QuantConnect has a more modern setup. It offers high-quality historical data for different kinds of assets. It also includes built-in data libraries, paper trading, and broker integrations. Since it’s online, there’s no need to manage installation or updates.

However, even though QuantConnect is easier, it is still not for beginners. Its documentation is dense, and the platform is more geared toward professional-level algo traders and institutional setups.

Backtrader gives you more control on your own machine, but it’s limited by your hardware and requires manual data management.

Use QuantConnect if:

- You want cloud-based infrastructure.

- You’re comfortable coding and working with APIs.

- You need access to a broad range of markets and data.

These were TOP-3 options we would recommend as an alternative.

Also read: Backtesting Algo Trading Strategies in 2025

Other Options

Now, let’s consider two more less popular tools, but maybe you will still find them as a perfect fit for your specific case.

4 Backtrader vs backtesting.py

Backtesting.py is a lightweight Python library built for testing trading strategies on historical data. Like Backtrader, it supports vectorized and event-based backtesting, but it’s much simpler and smaller in scope.

This tool is focused on ease of use and fast prototyping. Its API is clean, well-documented, and beginner-friendly. It uses popular libraries like Pandas, NumPy, and Bokeh for speed and visualizations. Traders can backtest forex, crypto, futures, or any market with candle data. There’s also a built-in optimizer and interactive charts.

Compared to Backtrader, backtesting.py is easier to get started with, but it doesn’t offer as many features. It lacks live trading support and broker integration. It’s mostly built for research and testing, not execution. Also, the project is operated by a small team and doesn’t have a large user community or ecosystem.

We haven’t tested backtesting.py ourselves, but the documentation on GitHub is clear, and the project is actively maintained. If you’re looking for a simpler Python-based tool to test ideas quickly, it might be worth a try.

5 Vectorbt vs Backtrader

Vectorbt is a high-speed Python library built for large-scale strategy testing and quantitative analysis. It’s designed for traders and data scientists who want full control, maximum speed, and deep customization — all inside a Jupyter Notebook.

Key differences:

- Speed and scale. Vectorbt is optimized for testing thousands of strategies at once. It uses vectorized NumPy operations and Numba for near C-level performance. Backtrader, in contrast, runs on an event-by-event loop and is much slower when scaling to big data.

- User interface. Backtrader uses a more traditional class-based structure. Vectorbt, however, represents everything in arrays and DataFrames. This makes it much faster, but harder to read for beginners or those not used to vectorized coding.

- Visualizations. Vectorbt integrates with Plotly and Jupyter Widgets to create interactive charts and dashboards. These can rival Tableau-like visuals — right inside your browser or notebook. Backtrader has basic matplotlib support, which works but is not as slick.

- Use case. Vectorbt is more suitable for users who want to test many parameters, timeframes, or assets all at once. It’s often used by quant researchers. Backtrader is more focused on strategy logic and event-based execution, with live trading integrations.

If you’re a Python-savvy trader working with data science tools, Vectorbt is a worthy alternative to Backtrader.

Conclusion

Backtrader is a solid tool for Python users who want full control over their algo trading strategies. It’s flexible, open-source, and has a loyal developer community. But it’s also complex, especially for traders without a strong programming background.

If you’re looking for something easier, Forex Tester Online is the best alternative. It offers manual strategy testing, historical tick data, and detailed analytics — all without requiring any code. It’s a practical solution for traders who want to backtest efficiently without the steep learning curve.

Other tools like QuantConnect and Zipline are good picks for those focused on automated or large-scale strategy development. They suit coders and quant developers who want full programmatic control over every part of their backtesting setup. In the end, if you didn’t like any of them, you may also try Vectorbt, and backtesting.py.

As always, pick the tool that fits your workflow, skill level, and the kind of trading you’re doing.

FAQ

Is Python Backtrader free to use?

Yes, Backtrader is open-source and free. You can download it from GitHub and use it without any license fee. However, since it’s community-maintained, official support is limited and updates are rare.

Can Backtrader be used for live trading?

Yes, Backtrader supports live trading through integrations with brokers like Interactive Brokers, OANDA, and Alpaca. But setting it up for real-time execution requires extra coding and debugging.

What are the limitations of Backtrader backtesting?

It is powerful but honestly not easy to use. It lacks built-in GUIs, and performance can slow down with large data sets or high-frequency strategies. It’s not ideal if you want a plug-and-play solution for strategy testing.

Is Backtrader good for charting and visualization?

Backtrader has basic plotting using matplotlib, but charting is not its strong point. If you need advanced, interactive visualizations, you might prefer a Backtrader alternative like Vectorbt or Forex Tester Online.

Can I use Backtrader for Forex and crypto strategies?

Sure, Backtrader can handle Forex and crypto if you supply the right historical data. But there is a thing you need to know: it doesn’t include market data by default, so you’ll need to import it from an external source or API.

Try our Best Backtrader Alternative

Try our Best Backtrader Alternative

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어